Hospitality Strategy

The hospitality markets have returned creating significant opportunity to develop, reposition and acquire assets.

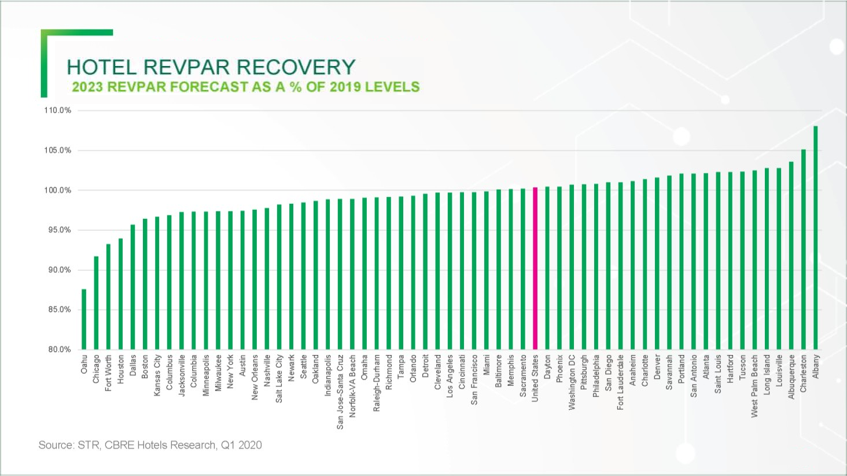

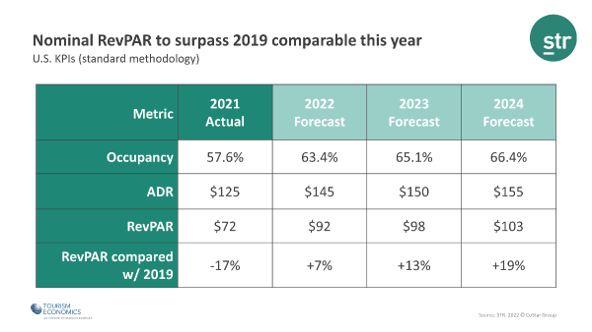

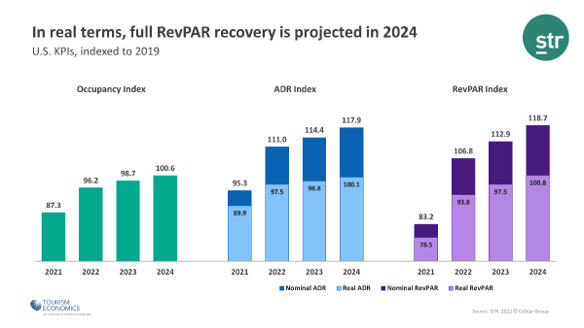

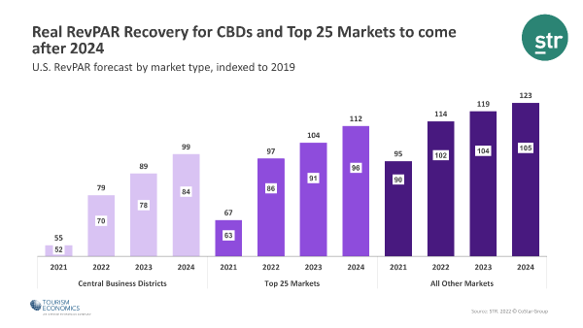

- US hotel markets continue their return to 2019 RevPAR levels

- Occupancy continues to improve

- Redpoint will target capital sources and other institutional investors that understand the post COVID demand drivers for hotel and mixed-use resort development

- Our sophisticated structuring allows for the maximizing of capital efficiencies providing the ability to underwrite all available options

- Construction costs and associated commodity pricing continues to decline and projected to level off by mid 2023

- Supply/demand imbalance due to hotel closures and conversions to other uses provide for new development opportunities

- Navigating cap rate spreads, interest rate increases and the difficultly projecting forward values requires experienced advisory skillsets

Download the latest hotelAVE Hospitality Dashboard

Published 8/15/2023